The Forex Trading Course Pdf

Our Forex trading PDF, it is widely believed that forex is 1 of the biggest and most fluid (or liquid) asset markets in the world. Sometimes referred to as FX, currencies are traded 24 hours per day – seven days per week.

The term 'forex' is a blend of 'foreign commutation' and 'currency'. In simple terms, refers to the process of exchanging i currency to another – and generally speaking, this will be for tourism, commerce, trading and many other reasons.

In this forex trading PDF we are going to talk most what forex trading is and some of the commonly used terminology in the industry. We will also explore the many different forex charts available, and we've thrown in some tips along the fashion to assist you to go a better forex trader from the beginning!

Table of Content

Acquire 2 Merchandise Gratis Signals Service

![]()

- Get three Gratis Signals per Calendar week

- No Payment or Card Details Needed

- Exam the Effectiveness of our Loftier-Level Signals

- Major, Small-scale, and Exotic Pairs Covered

![]()

What is Forex Trading?

With an boilerplate of around 5 trillion dollars traded daily in the forex arena, it's clear that this particular financial instrument is very popular with traders and investors the earth over.

Essentially, it is the action of selling or ownership foreign currencies. Of course, these are all used by banks, corporations and investors for a diversity of reasons like profit, making a trade, exchanging strange currencies and tourism.

One of the major benefits with forex trading is that after opening a position, traders are able to put in place an automated cease loss as well equally at turn a profit levels (this closes the merchandise).

The forex market is a place to buy or sell against each other a variety of national currencies, globally. The currency volition be changed from one currency to another, and currency pairs from all over the world are continuously trading 24/7.

Wherever two strange currencies are existence traded, you tin can be sure that a forex market exists regardless of the fourth dimension zone.

Commonly used Trading Terminology

In this section of our forex trading PDF, we are going to run through some of the nearly normally used forex trading terminologies in the industry.

Pips

Pip stands for 'indicate in percentage', and depicts any small changes noted in currency pairs within the forex marketplace. The pip represents the smallest amount possible a currency quote tin can modify. For instance, 0.0001 of a price quote – when it comes to the toll of a currency pair. This is referred to as the 'base of operations unit' of the pair.

If the bid price for GBP/USD pair changes from ane.2590 to ane.2591, this illustrates the difference of ane pip.

Spread

The differentiation between the sale cost and the purchase price of a currency pair is known equally the spread. The least popular (to the lowest degree commonly used) currency pairs unremarkably accept a depression spread. In some cases, this can be even less than a pip.

When trading the most usually used currency pairs the spread is ofttimes at its lowest. The full value of the currency pair needs to surpass the spread in society for the forex trade to go profitable.

Leverage

We couldn't create a forex trading PDF without mentioning leverage. In club for forex brokers to increase the number of trades available to its customers, they demand to provide majuscule in the way of leverage.

Earlier you can trade using leverage, you must sign upwards to a forex broker and open a margin business relationship. Contingent on the banker and the size of the position, leverage is usually capped at 1:30 if you are a retail client (non-professional person trader). Some offshore forex brokers volition offer much more than than this if yous are seeking higher limits.

Hither are a few examples for a better thought of leverage:

- Let's say that you are trading EUR/GBP which is priced at one.1700.

- Y'all retrieve the cost volition increase you lot you enter a purchase position.

- You simply have £500 in your forex trading account.

- You want to trade with more, so you use the leverage of 20x.

- The value of EUR/GBP increase by ii%.

- On a standard stake of £500, yous would have made a £ten profit.

- Only, as you applied leverage of 20x, this increased to £200.

However, if the value of the pair went down by 2%, you would lose £200.

It is because of the aforementioned example that y'all should exercise circumspection when using leverage. Should the worst possible scenario happen and your account falls below 0, you should contact your forex banker and enquire for its policy on negative balance protection.

The skilful news is that all forex brokers which are regulated by ESMA (the European Securities and Markets Authorization) will be able to provide y'all with this extra level of protection, ensuring that you never go in debt with your banker. It'south similar a stopper which prevents yous from dropping below 0.

Margin

Margins are a expert way for traders to build upwardly their exposure. Put just, in society for a trader to maintain position and identify a trade, the trader needs to put forrard a specific corporeality of money first – this is the margin. Rather than existence a transaction cost, the margin tin can be compared to a security eolith. This volition be held by the broker during an open forex merchandise.

Information technology is commonplace for forex brokers to give their customers access to leverage (see above). This is because generally speaking, the retail forex trader doesn't accept enough of a margin so that they can trade in loftier volumes (well, loftier enough to make a decent enough profit).

Hedging

In order for you to lower your gamble of exposure and offset your balance, yous might consider hedging. This is a procedure which involves traders selling and ownership financial instruments. When there are movements in currencies, a hedging strategy can reduce the risk of disadvantageous price shifts. The protection of this technique is often a short term solution.

Traders oft turn to hedge in a panic every bit a issue of the financial media reporting volatility in currency markets. This is unremarkably down to huge events like geopolitical turmoil (conflict in the center eastward), global health crunch (COVID-19) and of course the slap-up financial crisis of 2008.

To counteract negative toll movements, market players will tactically accept advantage of attainable financial instruments in the market. This is hedging against risk in its truest form. Hedging volition give you lot some flexibility when it comes to enhancing your forex trading feel, just there are still no guarantees that yous will be totally protected from any losses or risks.

To counteract negative toll movements, market players will tactically accept advantage of attainable financial instruments in the market. This is hedging against risk in its truest form. Hedging volition give you lot some flexibility when it comes to enhancing your forex trading feel, just there are still no guarantees that yous will be totally protected from any losses or risks.

A hedging strategy instance would exist:

- As a concerned investor, yous open a contrasting position on trade.

- To further explain, let usa say you accept a long position on GBP/USD.

- You might decide to open a brusk position on GBP/GEURBP likewise.

- This is also commonly referred to equally a directly hedge.

While information technology can take some time to get your caput effectually heading in the forex markets, the overarching concept is that it presents both outcomes. That is to say, irrespective of which way the markets move, yous will remain at the break-fifty-fifty point (less some trading commissions).

Spot Forex

The commutation rate of two currencies is ofttimes referred to as a 'spot' exchange rate. More than specifically, the spot trade is a spot transaction, with reference to the sale or the purchase of a currency. Substantially, spot forex is to both sell and buy strange currencies.

A skillful example of this is if you were to buy a certain corporeality of South African rands (ZAR), and exchange that for Usa dollars (USD).

If the value of the ZAR increases, you are able to exchange your USD back to ZAR, meaning you go more money back in comparing to the amount you originally paid.

Contract for Departure (CFD)

CFD is basically a contract which portrays the cost move of financial instruments. So, without having to own the nugget, you can still brand the most of toll movements, whilst also avoiding the need to sell or buy vast amounts of currency.

CFDs are likewise attainable in bonds, commodities, cryptocurrencies, stocks, indices and of course – forex. With a CFD you are able to trade in cost movements, cutting out the need to purchase them at all.

Dissimilar Forex Charts

This section of our forex trading PDF is all about forex charts. When information technology comes to a MetaTrader platform, traders can employ bar charts, line charts and candlestick charts. You can unremarkably toggle between the unlike charts, depending on your preferences, fairly easily.

Below we've put together an explanation of each type of chart for yous.

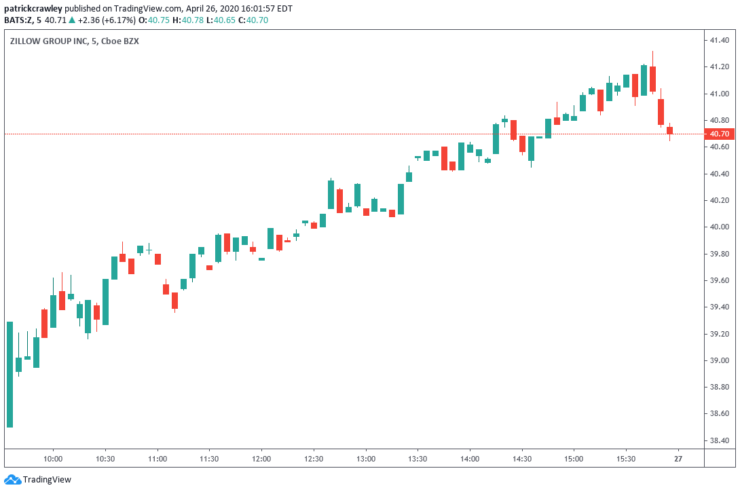

Candlestick Nautical chart

The first record of the now-famous candlestick nautical chart was used in Japan during the 1700s and proved invaluable for rice traders. These days, this price chart is without a dubiety one the most pop amongst traders all over the world.

Much similar the OHLC bar nautical chart (come across below), candlestick charts provide low, high, open up and close values for a predetermined fourth dimension frame. Live forex traders love this chart due to its visual appearance and the range of cost activeness patterns utilised.

It'south always advisable, unless yous are a seasoned trader, to make use of gratuitous demo trading modes. This allows you lot to gain a better understanding of how live trading works before you take whatever big fiscal risks in the market.

It'south always advisable, unless yous are a seasoned trader, to make use of gratuitous demo trading modes. This allows you lot to gain a better understanding of how live trading works before you take whatever big fiscal risks in the market.

OHLC Bar Chart

Continuing for 'Open, Loftier, Low, Shut', the OHLC chart is great for portraying whatever motility in the cost of an nugget, washed over a specific time (for example – ane hr, or a trading day).

As the title suggests, this one is a bar chart, and each time frame a trader is looking at will exist displayed as a bar. In other words, if yous are viewing a daily chart you will see that every bar equates to a full trading day.

Unlike the line nautical chart (see below), the OHLC bar chart is unique in the sense that it displays a wider multifariousness of values and information like 'open', 'high', 'depression' and 'close', hence the name.

Unlike the line nautical chart (see below), the OHLC bar chart is unique in the sense that it displays a wider multifariousness of values and information like 'open', 'high', 'depression' and 'close', hence the name.

- The highest market cost traded within the selected timeframe volition be represented past the high of the bar.

- The lowest market toll traded inside the selected time frame is represented past the low of the bar.

- The nuance on the correct volition represent the closing price, and the nuance on the left volition be the opening cost.

- The red bars are also called seller confined; this is due to the fact the endmost cost is less than the opening price.

- The dark-green bars are also referred to as buyer confined; reverse to to a higher place. This is because the opening price is lower than the endmost toll.

With this cost chart, traders are able to institute who is decision-making the market, whether it exist sellers or buyers.

OHLC analysis was the starting block for the creation of the ever-popular candlestick charts (please farther down).

Line Nautical chart

This chart is considered to exist the most elementary type of cost chart, but that doesn't mean it's not useful. Information technology is a groovy tool for looking at the bigger motion-picture show when it comes to trends.

It does depend on what time frame you are viewing (this tin can be annihilation from minutes to months), but for statement's sake allow's say you lot are using a daily chart. The line nautical chart arranges the shut prices at the end of that time frame; so in this case, at the finish of the day, the line will connect the endmost price of that day.

Forex – How to Merchandise

In this department of our forex trading PDF, we are going to talk almost the different means in which you tin sell and buy a forex position besides equally things to look out for.

Pricing and Quotes

When it comes to forex trading you will run across both 'bid' and 'ask' prices:

- Bid toll : This is the price you can sell currency at.

- Enquire toll : This is the price y'all are able to buy currency at

When information technology comes to forex trading y'all can trade both short and long, but always make sure yous have a adept agreement of forex trading before embarking on trades. After all, forex trading can be a flake circuitous to begin with, especially when mixing long and curt trades.

Long Merchandise (Buy)

In a nutshell, going long is commonly a term used for buying. So, when traders expect the toll of an asset to rise, they will get long.

As an example of a long position:

- Say you've held a long position in the primary musical instrument purchased

- For case, USD/JPY

- This ways that you are anticipating that the USD is going to increment in value confronting the JPY

- If you lot invest £1,000 into USD/JPY through a long position, then you just £1,000 staked that the pair volition increase in value

Curt Merchandise (Sell)

When forex traders expect the price of an asset to fall, they will become short. This means benefiting from buying at a lesser value. To achieve this, you simply need to identify a sell lodge.

Current Prices and Demand

The current exchange rate of a forex pair is ever based on market forces. This volition alter on a 2nd-by-second basis. As nosotros noted earlier, you also need to take the spread into business relationship, so there volition always be a slight variation in pricing.

For example, if you commutation ane USD for 17 ZAR, the sale and purchase price offered by your forex broker will exist either side of that figure. The currency pairs with the most notable supply and demand attached to them will be considered the most liquid in the forex market. The supply and demand aspect is thanks to the investment of importers, exporters, banks and traders – to proper name a few. This is how the forex arena is home to over $five trillion worth of buy and sell positions each and every day!

The most liquid currency pairs are therefore the ones in high demand. Equally an example, GBP/USD offers a lot of short-term trading opportunities due to the sheer amount of pips moved each and every twenty-four hour period (90-120 on average). On the contrary, AUD/NZD doesn't tend to move many pips in a day. Having said that, if you have a practiced understanding of some of the more exotic currencies- we at Learn 2 Trade are not saying it's incommunicable to do well.

The most liquid currency pairs are therefore the ones in high demand. Equally an example, GBP/USD offers a lot of short-term trading opportunities due to the sheer amount of pips moved each and every twenty-four hour period (90-120 on average). On the contrary, AUD/NZD doesn't tend to move many pips in a day. Having said that, if you have a practiced understanding of some of the more exotic currencies- we at Learn 2 Trade are not saying it's incommunicable to do well.

Forex Trading System to Consider

When you feel you are ready to accept the plunge and begin live trading, you demand to select a forex trading system. At that place is a vast corporeality of trading strategies for y'all to pick from. This is because investors, speculators, corporations and banks have been trading for decades.

In this part of the forex trading PDF, we are going to explicate a few of the strategies available to you.

- Intraday Trade: Concentrating on one-hour or 4-hour cost trends, forex intraday trading is considered more of a conservative mode of trading. Focusing on the leading sessions for each individual market, these trades remain open for anywhere betwixt i and 4 hours. As such, this could make information technology a suitable option for beginners.

- Currency Scalping: This particular strategy is oft viewed as a low-risk form of trading. It is focused on selling and buying currency pairs within an extremely curt time frame. This is usually anywhere between a thing of seconds, and two to 3 hours at the most. This strategy makes it very applied to potentially gain a number of smaller profits, with the promise of creating a stockpile of profits.

- Swing Trading: Often referred to as a medium-term approach, unlike scalping and intraday, swing trading concentrates on bigger price movements. With this strategy, traders are able to leave their trade open for days or even weeks. Some traders like to use this choice in order to embellish existing daily trades.

Trading Platforms – Explained

If you desire to buy and sell currency pairs from the comfort of your dwelling (or even via your mobile device), you will need to employ a trading platform. Otherwise referred to as a forex banker, there are literally hundreds of trading platforms agile in the online space. This makes it extremely difficult to know which broker to sign upward with.

In the below sections of our forex trading PDF, we explicate some of the considerations that you demand to make.

Assay Tools and Features

Yous should besides look out for analysis tools available to you. In some cases, this might be embedded, while some offer tools such every bit technical analysis and central analysis. There's no doubt that having access to a range of technical indicators, live price charts, and current news and data from the financial marketplace is an essential role of forex trading.

However, if yous can access these technical indicators within your trading platform, it's going to testify to be very useful. This is because it volition salvage you a lot of leg work having to move between different sites and sources of information.

Some of the fastest and easiest trading platforms are MetaTrader 5 (MT5) and MetaTrader iv (MT4). Whilst MT4 was created especially for forex traders, MT5 gives traders access to CFDs (For CFDs, please see caption under 'Ordinarily used Trading Terminology' in this forex trading PDF).

Crucially, both MT4 and MT5 are fast and receptive trading platforms, both providing alive marketplace data and access to sophisticated charts.

Conviction in Your Forex Broker

It is essential before you begin trading seriously that you fully trust the trading platform you lot intend on using. This is especially the case if you lot intend on using a scalping strategy, for case.

Nevertheless, if you similar to trade, it is vital for your peace of mind and your finances that you are fully confident with the fast execution of data transfer. This is also the case with the precision of quoted prices, and the speed of order processing. All of these things are going to assist you lot to have a successful forex trading feel.

To enable yous to make the most of new opportunities, the ideal forex banker will be available to you 24 hours a day and 7 days a week, in line with the forex market opening hours.

Contained Account Managing director

To salvage yous from having to asking that your broker takes activeness for you, your forex broker should enable y'all to manage your account and your trades separately.

Past doing this, you will be in a much better position to speedily react to any shifts in the market, and hopefully, make the most of potential opportunities. This volition enable yous to gain amend control over whatever open positions as and when they ascend.

Safety and Security

It is of import to ensure that your forex broker of selection is a reputable visitor, who will ensure that your personal information and trading funds are fully protected and backed upwards.

Segregation is oftentimes used amongst forex brokers equally a way to carve up your funds from the funds of the company (i.e their daily costs, debts and running costs). So, no matter what happens to the forex banker, your coin is safe and segregated.

If you lot find that a forex banker is unable to practice this, we would suggest yous notice a better broker as it is standard practice these days. All of the brokers listed towards the end of this forex trading PDF are regulated by at least one reputable licensing trunk.

Forex Trading – Getting Started

In terms of getting gear up every bit an online forex trader, the steps remain constant regardless of which broker yous decide to join. Below we list some of the steps that you will demand to take.

Step 1: Open an Account

In order to open up an account, you will demand to enter some personal information. Standard details requested past the broker will be things similar your name, residential address, and contact details.

Some brokers volition also require your revenue enhancement status and will enquire you to provide more than financial details such as employment status, net worth and any regular income.

Step 2: Trading Experience

Forex brokers will often want to ensure you lot accept some level of trading experience (however this isn't always the instance). In this instance, you lot will ordinarily demand to answer some multiple-pick questions based on your experience. This is normally a fairly simple process.

Step iii: Verifying your Identity

Known as KYC in the manufacture (Know Your Customer), this simply means that the forex broker is going to need you to testify who you lot are. Some brokers will verify this using scanned copies of documentation. This is typically a government-issued ID (passport or driver'south license) and a proof of address (utility bill or banking company account argument).

Stride four: Depositing Funds

Now you need to select your payment method of selection (usually from a drop-down list). Bear in listen that how long this takes to go into your trading business relationship will largely depend on the payment method – so always check this before parting with your cash.

Supported payment methods typically include a debit/credit card or banking concern account. Some brokers even support e-wallets like PayPal and Skrill.

Step five: Begin Trading

After reading our forex trading PDF yous should now be feeling confident plenty to begin trading. However, we practise recommend that yous ever try out a complimentary forex trading demo start. This will allow y'all to test out your newly formed trading strategies before risking your ain capital.

Forex Trading Strategies

In the next section of our forex trading PDF, we explore some of the more than of import technical indicators and market insights used by seasoned traders.

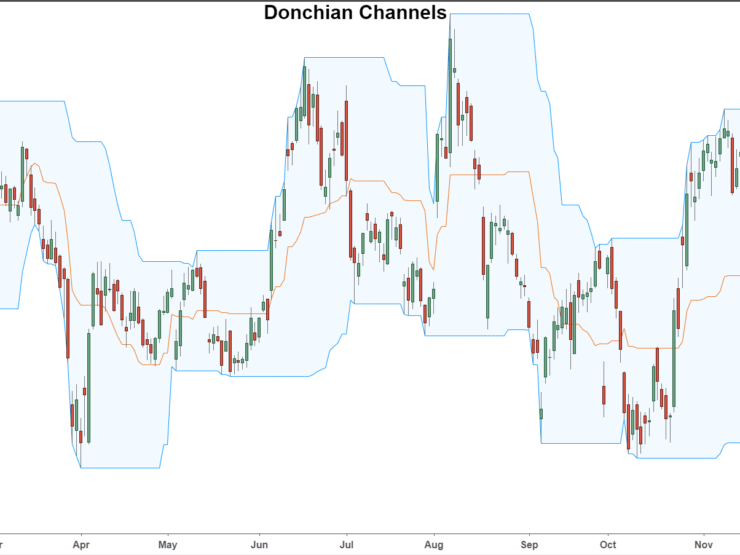

Donchian Channels

Beginning invented by Richard Donchian, the donchian channels tin can exist adapted as you lot like, in terms of parameters. Should you cull to view a 30-day breakdown, for example, the indicator will be created past taking the everyman low, and the highest loftier of that catamenia (so in this case 30 periods).

When observing the moving average on a donchian channel yous can look at averages stretching from 25 days to the final 300 days. The direction which is permitted is determined by the direction of the brusk-term moving boilerplate.

When observing the moving average on a donchian channel yous can look at averages stretching from 25 days to the final 300 days. The direction which is permitted is determined by the direction of the brusk-term moving boilerplate.

With this in mind, you lot should think almost opening 1 of the following two positions:

- Long – If t he terminal 300-mean solar day moving average is lower than the 25-24-hour interval moving average.

- Short – If the last 300-mean solar day moving average is greater than the 25-day moving average.

You will need to sell your pair in order to exit your trade if you lot open up a long position (and visa-versa).

Simple Moving Average

This is another normally used forex indicator. The simple moving boilerplate (aka SMA) operates at a slower rate than the present market price (known equally a lagging indicator). Furthermore, it uses a lot of historical price data. In fact, more than so than well-nigh other strategies.

A good indication that the latest price is higher than the older price is when the long-term moving boilerplate is below the curt-term moving average. This could be considered a buy point due to an upward trend in the market place.

In the reverse scenario when the long-term moving average is higher than the brusque-term moving boilerplate, this of course points towards a sell signal due to a downward trend. Moving averages are unremarkably used as prove of an overall trend, rather than purely forex trading signals.

This means you lot can blend both strategies in order to ditch breakout signals which don't match up to the full general trend the moving averages suggests. Of grade, this is a great way to make your breakout signals much more than productive. If you are alerted to a sell signal, this indicates that the short-term moving average is below that of the long-term moving average, so you might want to place a sell order.

Nonetheless, if you are given a betoken to buy, this commonly means that the short-term moving average is higher than that of the long-term moving average.

Breakout

Using breaks every bit trading signals, the breakout is considered a long-term strategy. Commonly referred to as 'consolidation', markets sometimes alternate between resistance and back up bands. The breakout itself occurs when the market goes further than these consolidation limits – whether that exist lower or college. Every bit such, a breakout must take place whenever a new tendency occurs.

Past looking at breaks, you volition have a expert indication of whether or not a new tendency has begun. With that said, this doesn't mean that a breakout is 100% authentic in signalling a new tendency. In this case, you lot might desire to use a cease-loss order to give you a better chance of fugitive a substantial loss.

Forex Trading: Possible Risks

As glamorous equally a career in forex trading might audio, there are a number of risks that y'all demand to take into account. In the below sections of our forex trading PDF, we explore these possible risks in more than item.

Transactions

The transaction run a risk is in relation to the substitution charge per unit and whatsoever time zone differences. This means in that location is a chance that at some signal between the showtime and finish of a contract that the exchange rates could exist subject to change. The risk of this happening elevates with the more time that passes between entering a contract and settling the aforementioned contract.

Involvement Rates

The take a chance here is that if a country's interest rate falls, the currency of that country will probably exist weaker. This generally leads to investors withdrawing investments, and equally a effect, your return volition be lower.

The good news is that when a currency rate is on the ascension, chances are that the respective currency will exist stronger. When this does happen, your returns could exist higher. This is considering seasoned investors similar to gain exposure to stronger currencies.

Leverage Risk

The higher your leverage is, the higher your losses or benefits will exist. Of grade, this means leverage can affect your trading in a positive or negative way – depending on which way information technology goes.

Best Forex Trading Brokers of 2022

The final part of our forex trading PDF is to explore which brokers are popular with both newbie and seasoned traders. Each of the forex trading platforms listed below has been pre-vetted, pregnant that you tin can be confident they tick about boxed.

This means that each platform is regulated, offers heaps of forex pairs, has low commissions and fees, and supports several payment methods.

1. AVATrade – two x $200 Welcome Bonuses

AvaTrade is an established broker that offers thousands of fiscal instruments. On meridian of stocks, indices, bolt, and cryptocurrencies (all via CFDs), y'all can as well merchandise heaps of forex pairs. There are no trading commissions to pay, and spreads are very competitive.

You can either merchandise via the AvaTrade web-platform, or via popular third-party provider MT4. Minimum deposits stat at $100, which you tin can facilitate with a debit/credit carte du jour or banking concern business relationship. The platform is heavily regulated, with several licenses under its belt.

.

- xx% welcome bonus of up to $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

75% of retail investors lose money when trading CFDs with this provider

2. Capital.com – Zip Commissions and Ultra-Low Spreads

Majuscule.com is an FCA, CySEC, ASIC, and NBRB-regulated online broker that offers heaps of financial instruments. All in the course of CFDs - this covers stocks, indices and commodities. Yous will non pay a unmarried penny in commission, and spreads are super-tight. Leverage facilities are as well on offer - fully in-line with ESMA limits.

Once again, this stands at ane:30 on majors and 1:20 on minors and exotics. If you are based exterior of Europe or yous are deemed to exist a professional client, you volition get even college limits. Getting money into Capital.com is too a cakewalk - as the platform supports debit/credit cards, eastward-wallets, and bank account transfers. All-time of all, yous can get started with merely 20 £/$.

- Zero commissions on all assets

- Super-tight spreads

- FCA, CySEC, ASIC, and NBRB regulated

- Does not offering traditional share dealing

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you can afford to take the loftier adventure of losing your money.

To Conclude

Having made it this far through our forex trading PDF, yous should by now have an understanding of how technical analysis works, and have a good grasp of the macroeconomic fundamentals which guide currency values. Armed with all of the useful information included in this guide, you should exist ready to get out at that place and start trading forex. Hopefully, making a profit and learning more along the way.

If you are a trader with somewhat limited funds, you lot might find that swing trading suits you best. If you lot take a larger trading fund available to you, y'all might accept a more profitable experience with cardinal based trading. Either manner, w e do recommend trying out a free demo business relationship where possible before trading with your difficult-earned coin. Too as reading helpful guides like ours, actually learning past doing will also provide you with a better sense of how it all works and how you might like to trade yourself.

Learn 2 Trade Costless Signals Service

![]()

- Get 3 Free Signals per Calendar week

- No Payment or Card Details Needed

- Examination the Effectiveness of our High-Level Signals

- Major, Minor, and Exotic Pairs Covered

![]()

FAQ

What does forex mean?

Forex every bit a term refers to 'foreign exchange'. More specifically, it refers to the process of buying and selling currency pairs like GBP/USD and USD/ZAR.

How practice you make coin in forex?

You volition brand money in two unlike scenarios. You either buy a currency pair for less than you sell it for (long society), and y'all sell a currency pair for less than you bought it for (short order).

What is the spread in forex?

The spread is the departure betwixt the bid and ask cost of a forex pair. This gap in pricing must be included in your profit and loss forecasts, and it is how the broker ensures that the platform always makes money.

What is a good spread in forex trading?

This depends on the type of forex pair you lot are trading. If you are trading highly liquid majors similar EUR/USD, you lot should not be paying more than than 1 pip.

What is the pip in forex?

The pip refers to the movement of one decimal identify in a pair. For case, if GBP/USD is priced at 1.2450, and it moves to i.2451, so this is a motility of ane pip.

What leverage limits are in identify when trading forex?

This depends on several factors, such every bit your location, the currency pair, and the broker itself. In well-nigh cases, traders from the UK and Europe are capped to leverage of i:30 on major pairs and ane:20 on small and exotic pairs.

Slippage ways that your forex order is executed at a slightly unlike price to what you had asked for.

Read more related Articles:

Gratuitous Forex Signals Telegram Groups of 2022

Forex Trading for Beginners: How to Trade Forex and Find the All-time Platform 2022

Best Forex Signals 2022

All-time Forex Brokers 2022

The Forex Trading Course Pdf,

Source: https://learn2.trade/forex-trading-pdf

Posted by: milamzild1970.blogspot.com

0 Response to "The Forex Trading Course Pdf"

Post a Comment