Forex Trading Strategies For Dummies

Range Trading Strategy

Range trading is not reserved for the Wild West of the markets, but information technology is certainly beneficial when a market lacks direction. The most of import key to range trading is to notice support and resistance to define the range. As with any trading strategy, this technique as well requires strategic direction of risk in the upshot of a breakout. Range trading strategy is ane of the most effective trading strategies associated with Forex trading. In the absence of a trend or a direction in the markets. you, too, tin can carve your own path to prosperity using a range trading strategy. Let's learn more nigh this innovative range trading strategy.

Range Trading Strategies:

>Step i: Find Your Range

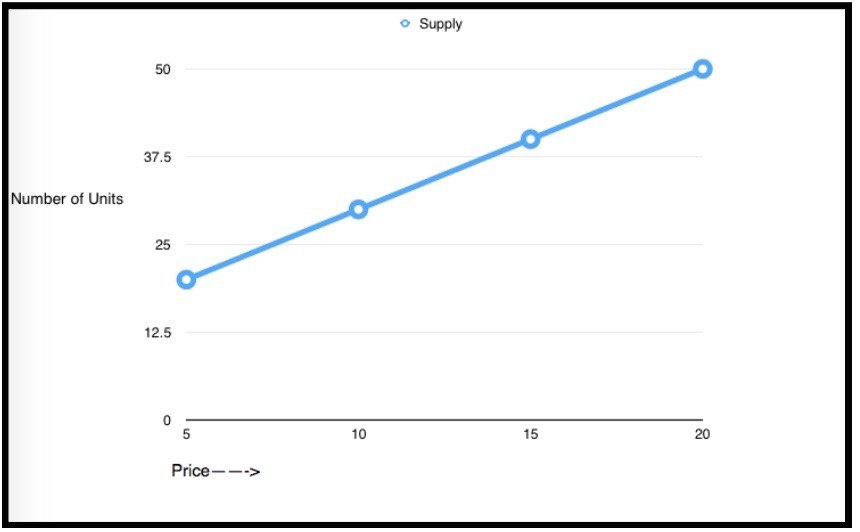

The first step of the range trading strategy is to find the range. Forces of supply and demand can impact prices in the forex market, and this is where back up and resistance enter the equation. Helping traders locate levels in which a supply and/or need in a given currency pair may transform once lines have been crossed. Supply is the corporeality available at a sure price, while need is the amount required or wanted at a specific price. The prices of a production or instrument can have a massive affect on the amount demanded by the marketplace or the supply that i can go. When price increases, the seller'south willingness to offload the production volition also rise, illustrated by the supply curve, which shows how boosted units get bachelor as prices increment.

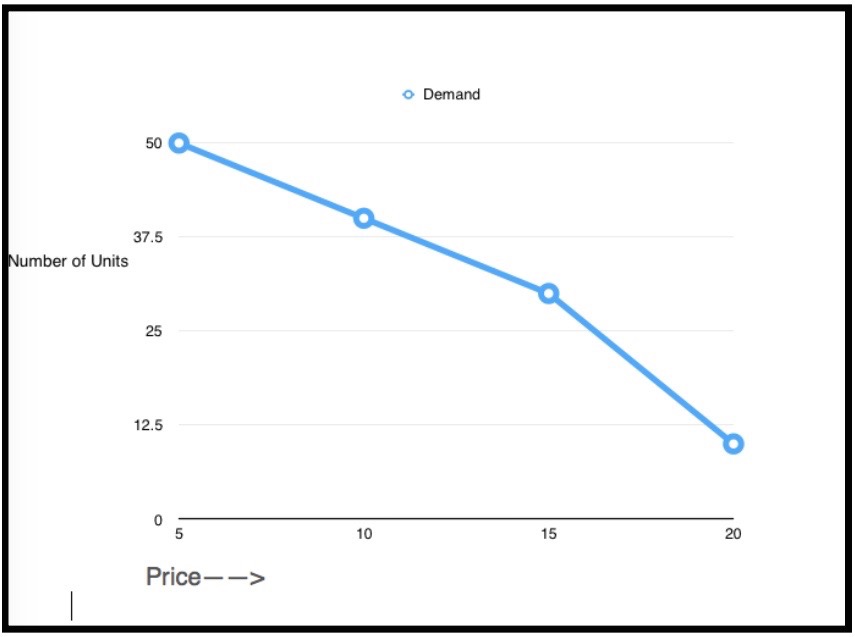

On the other side of the divide, buyers will demand more at prices that are lower, and every bit cost rises, demand falls, as tin can be seen in the need curve below:

Supply and demand play out through support and resistance. Support is the point at which need begins to outstrip supply causing prices to shoot higher. Resistance is the contrary. Breakouts hold that the prediction of the stimuli causing price change may exist hard to forecast.

Traders need to be articulate whether the trading environment volition stay the same or change, influencing whether you trade for a range or a breakout.

Trading the Range: Status Quo

When trading a range, traders are holding that the environment will remain the same with support or resistance staying at certain levels. Price can exist used to define points in the market place when demand outstrips supply creating increased prices or vice versa. If breaks of back up or resistance work to create new highs or lows, the aim of the trader ranges from range-bound weather condition to sell back at a college toll or purchase dorsum at a lower toll depending upon the nature of the breakout.

Finding the range involves using zones. Zones can be created through a series of short-term highs and lows and connecting these through horizontal lines. An overhead range is a resistance, while support is the area where price helps up by traders looking to make the big purchase.

Step 2: Timing the Entry

Traders can time range trading entries through numerous methods.

Oscillators: Some of the most popular oscillators include RSI, CCI, and Stochastic's. These technical indicators serve to track prices that calculate how far the indicator is fluctuating along the centerline. Indicators plow farthermost as price reaches a zone of support or resistance.

Step 3: Managing the Run a risk

The final office of a successful range trading strategy is run a risk management. When a level of support or resistance breaks ( equally it will), traders have to exit range-based positions by using end-loss above the earlier high when making a auction within the resistance zone of the range. The procedure tin can also exist inverted with a stop below the current low while purchasing support.

Sniffing out the profits in range trading is equally simple. In selling a range, orders should be express to have profit downwards near back up. When purchasing support, profit orders should be placed at earlier identified resistance.

Tricks of the Trade: Range Trading Strategy

Traders can get the all-time results by using the range trading strategy about suitable for current market place atmospheric condition. Ranges are a effect of price getting defenseless betwixt support and resistance. Remember that ranges are hard to trade, and traders will eschew ranges to trade in trending or breakout situations. Trends tin be grabbed on to, and breakouts offer a wonderful chance to pause even in the markets, merely ranges are another kettle of fish altogether. To catch the range, prices have to go defenseless between support and resistance. When this occurs, traders can accost the range in 1 of two means and merchandise for the range to go along, which ways the upside is limited or looking for the breakout from the range in the face of a new trend.

Trading Ranges or Looking for Breakouts: The Trade-Off

Traders often ignore ranges every bit they perceive the profit potential to exist restricted. If a range is being traded through ownership support, so traders are nearing the position of resistance. This is a limited upside type of proposition. Of course, this does not have the lure of a tendency or breakout where traders tin get on the right side and risk up to 3 to four times their uppercase.

The reality of trading is that the range is the market condition likely to exist encountered almost all the time.

In the Heart of a Ranging Tempest?

Ranges can develop in multiple ways. For example, the short-term range is towards the showtime of an uptrend as buyers and sellers fight to fend off and gain control over the coming trend. Another situation where the range may consequence is when a long bout of indecision leads to congested cost movements that stay restricted between support and resistance levels. Regardless of the context, if prices are spring between resistance and support, then a range-bound menses occurs in the markets.

If traders are going to engage in range trading, they have to be clear that risk management is taking place properly as breakout moving in the opposite management of the trader'southward position tin lead to massive losses that come up about when the breakout turns into tendency pushing traders against the equity line. Therefore, trading ranges are only possible when a breakout against the trader's position stops.

The goal backside the range trading strategy is elementary. It is the same every bit when you are trading trends – the aim is to buy low and sell high. Another requirement for range trading is that price action must be leap between resistance and support. If previously established support and resistance remain respected, a profitable position may be visible to the trader.

A difficult aspect of this is prices will often not here to exact identical cost equally back up or resistance. Zones effectually supportive besides equally resistant prices are way more applicative. Toll activity assay has many benefits for the trader. The benefits of strong reeds can exist obvious, merely what is every bit apparent is that the market will non tendency forever. Markets may struggle to find a divers management. Identifying support and resistance through cost activity is the basic aim. Traders tin identify inflection points in the market based on where the price has previously traded. The benefit of this can be tremendous. While past prices cannot exist future projections, they tin can provide a inkling about the stance of swing highs and lows of the market. Markets often swing in a bid to find the perfect intrinsic value. Longer fourth dimension frames are easier to trade ranges because you lot tin get a bird'due south eye view of the market and secure advantages from a vantage point.

Once yous identify the prices at which buying and selling volition take place, and when trading volition terminate, the conclusion to enter the trade tin then exist taken. Again, seeking risk to advantage ratios of i to 1 or higher is the way out. This ensures that prospective turn a profit equals potential loss.

Zones of support and resistance tin can ensure range-spring conditions are more than feasible. Additional elements of back up or resistance in the range include pin points, psychological whole numbers, and more. One time traders accept seen a price action swing around a certain toll, validating the level of the price as ane which markets take breached and may do so over again, range trading tin can be taken a step further.

Bear in listen that just as no tendency is permanent, similarly, no range volition final forever. Traders can employ the information for benefits while trading ranges. If a trader guys support anticipating the continuation of range and the opposite happens, traders need to have a second look. If the breakout is not existent and the range fills as the trader has anticipated, information technology could also pelting away profits of trade runs to the finish. This is not the right way to handle a range. Some position direction is needed in the event that breakout could happen. Traders need to close a portion of the position for prices to reverse, and the remaining part of that position tin can reap the rewards if a breakout does, in fact, break out. Scaling out of the trade is a similar footstep. If the breakout happens to plow into a fresh trend, the trader can step into a earth of rising profits if the tendency should continue. Traders demand to look out for that they should adjust their stops to breakeven, so fifty-fifty if breakouts don't equal fresh trends, the residual of the position can be taken out at the original entry toll.

Trading Range-Bound Currencies:

This is more common than trading in range-bound securities, but exactly the aforementioned principles employ in both cases. The fundamental strategy involves finding support and resistance zones that are closely established and trading at these levels until the breakout inevitably occurs. An abundance of information on its exchanges makes the United states of america dollar a better pick for Forex traders. Only regardless of the currency pair, the first step to create a range-leap trading stratagem is to appraise divers lines of support and resistance. Optimal currency pairs are not quickly moving, allowing traders to react to either of the 2-support or resistance. Traders can enter merely long before the support toll and identify a stop but beyond this. Inbound short prior to the resistance purlieus works in the contrary way.

Currently, there is non much scope as far every bit the altitude between higher and lower boundaries is concerned. This leads to limited upside potential, and so entries and exits need to be set up quickly. Range trading is not virtually direction; information technology is all near identifying overbought and sold conditions within the range boundaries. From interest rates to government policies to those of the central bank, engaging in fundamental assay forms the basis of successful range trading. So, even if you prefer technical assay, cardinal analysis is the mode to go if you desire to engage in range trading.

Conclusion

Range trading strategy is all about placing the bets when you know the outcome courtesy of the toll action. Finding out the back up and resistance zones is the fundamental to a successful range trading strategy. Learning how to counter breakouts and catch the trend or buck it when the need arises is important. This forms the essence of successful range trading. Currency trading is a tough proposition for beginners but what counts is the perseverance and utilize of logic. Range trading emphasizes the most important aspect of trading- sticking to the golden hateful or shut to it, at any rate.

It is more possible that markets will tendency for some time and stay within the range for others; after all, everything that goes up must come down, and markets seldom defy the police of gravity, given the circuitous factors that influence their motion. Range trading is the perfect mode to add to profits and cut downwards on losses. The skill of a range trader grows with time and feel; the longer the menstruation for which trading is taking place, the more skill a trader acquires. Though short-term range trading strategy is not uncommon, long-term range trading strategy yields benefits and profits inside a bridge of time and provides rich dividends.

Related Articles:-

This has been a guide to the range trading strategy. Still, hither are some manufactures that will help you lot to get more than particular about Currency Trading, then just go through the link.

- Swing Trading Strategies

- Currency Exchange Market

- Forex Trading For Beginners

Source: https://www.educba.com/currency-trading-range-trading-strategy/

Posted by: milamzild1970.blogspot.com

0 Response to "Forex Trading Strategies For Dummies"

Post a Comment