indicator rules for swing trading strategies

Does the market always look to displace lower after you hit the buy button?

Do you wish your trade bequeath be over soon because you Hatred to watch your Pdanamp;L cu up and down?

Are you frustrated to examine the market ALMOST reached your target profit, but sole to do a 180-degree reversal and hit your stop loss?

If you replied YES to any of the above, then I've got the answer for you.

Golf sho trading.

Now you might be questioning:

"What is swing trading and how does it work?

Wear't worry.

Because therein post, you'll learn everything you need to know nearly swing trading — including 3 golf stroke trading strategies that work.

Sounds good?

Then let's begin…

Sweep Trading Fundamental principle: What is swing trading and how does it work

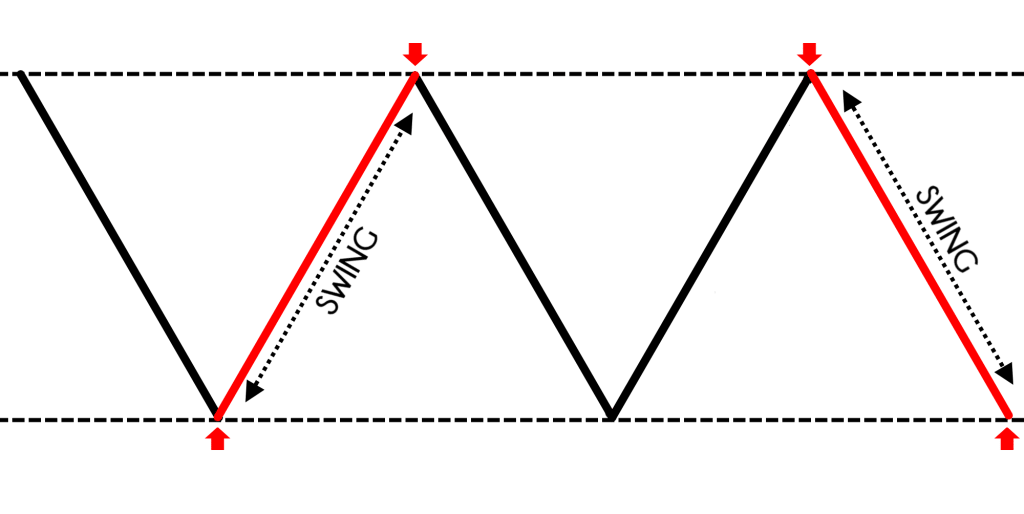

Swinging trading is a trading methodology that seeks to capture a swing (or "one move").

The idea is to endure as "little pain" as possible past exiting your trades before the opposing pressure comes in.

This means you'll book your profits before the commercialize rescind and wipe out your gains.

Here's an example:

Next, here are the pros danamp; cons of swing trading…

Pros:

- You need not expend hours ahead of your ride herd on because your trades last for days operating theatre eventide weeks

- Information technology's suitable for those with a full-time job

- Fewer try compared to mean solar day trading

Cons:

- You won't be capable to ride trends

- You have long take a chanc

So far so angelic?

Then permit's progress…

Swing trading strategies #1: Stuck in a box

And one thing…

The swing trading strategies I'm about to part with with you suffer "interesting" name calling betrothed to it.

This helps you empathize the trading setup better and then you know how to put on information technology to your trading.

Now, let ME introduce to you the first swing trading strategy for today…

Stuck in a boxwood.

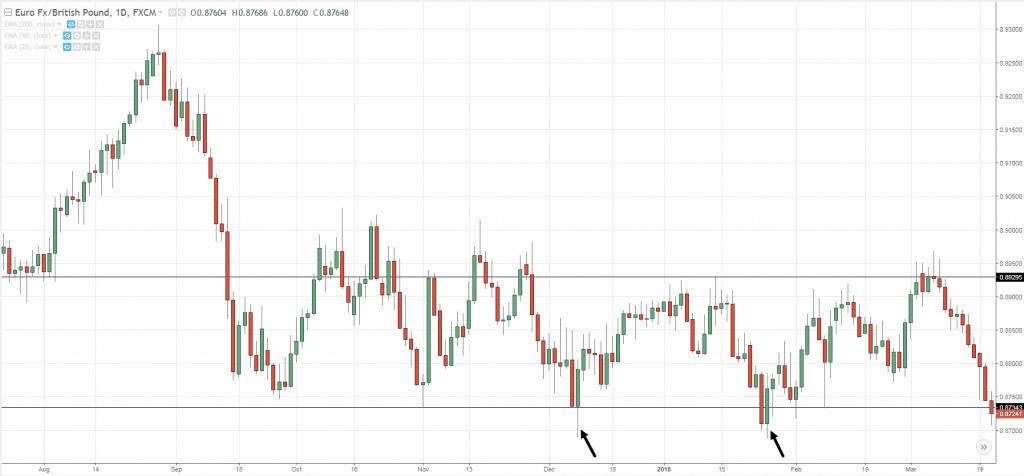

Information technology's swing trading in a range market because the market is "stuck" between Support and Resistance (fairly alike a box).

Here's how it whole works:

- Describe a range market

- Wait for the toll to break below Support

- If the toll breaks below Support, past look for a strong terms rejection (a close above Support)

- If there's a strong terms rejection, then go nightlong on the incoming candle unsettled

- Set your break off loss 1 ATR below the candle low and bring up profits before Resistivity

Here's an example:

Now you might be speculative:

"Why should I take profits before Impedance?"

Recall…

As a swing monger, you're lonesome looking for "one move" in the market.

So to ensure a high probability of achiever, you lack to go your trades before the selling pressure steps in (which is at Electrical resistance).

Fix sense?

Good because we'll be applying this conception to the remaining get around trading strategies.

Side by side…

Swing trading strategies #2: Catch the brandish

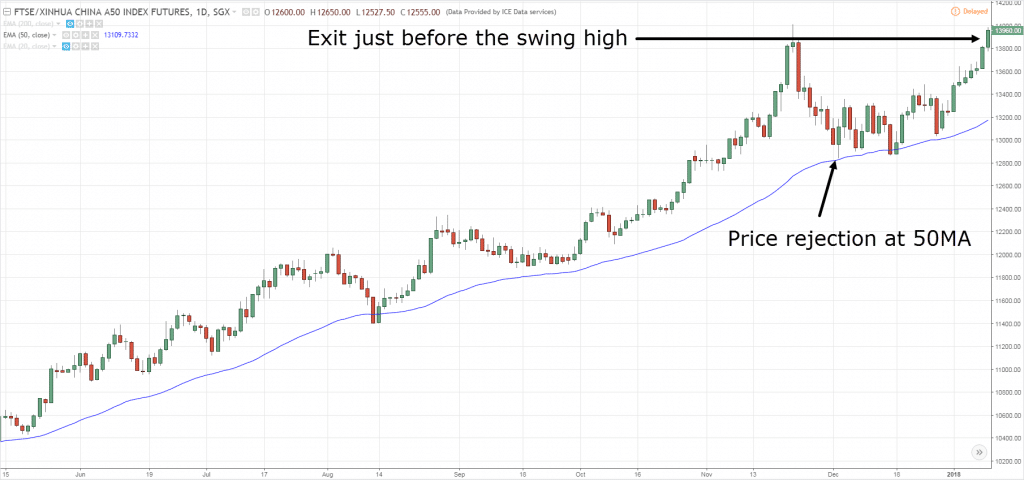

This swing trading strategy focuses on catching "nonpareil move" in a trending market (the like a surfboarder trying to catch the wave).

The idea here is to enter after the pullback has ended when the trend is in all probability to continue.

However…

This doesn't work for all types of trends.

Instead, you want to trade trends that have a deeper tieback because there's more "meat" towards the upside.

Eastern Samoa a guideline, you deprivation to see a pullback leastwise towards the 50-period moving median (MA) or deeper.

Now, let's learn how to catch the wave with this swing trading scheme…

- Identify a trend that respects the 50MA

- If the marketplace approaches the moving average, then wait for a bullish price rejection

- If there's a bullish price rejection, and then go long on next candle

- Arranged your stop loss 1 ATR below the low and take profit just earlier the swing high

Here's an example:

Act up you want more examples?

And so work watch this training video where I'll point you how to identify more swing trading setups step by step…

Now you might be wondering:

"But why the 50-period moving average?"

I go with the 50MA because it's watched by traders around the Earth so that could head to a self-fulfilling prophecy.

And ordinarily, the 50MA coincides with previous Resistor turned Stand which makes it more significant.

Now, it doesn't mean you crapper't use 55, 67, 89, or whatever moving average you choose because the concept is what matters.

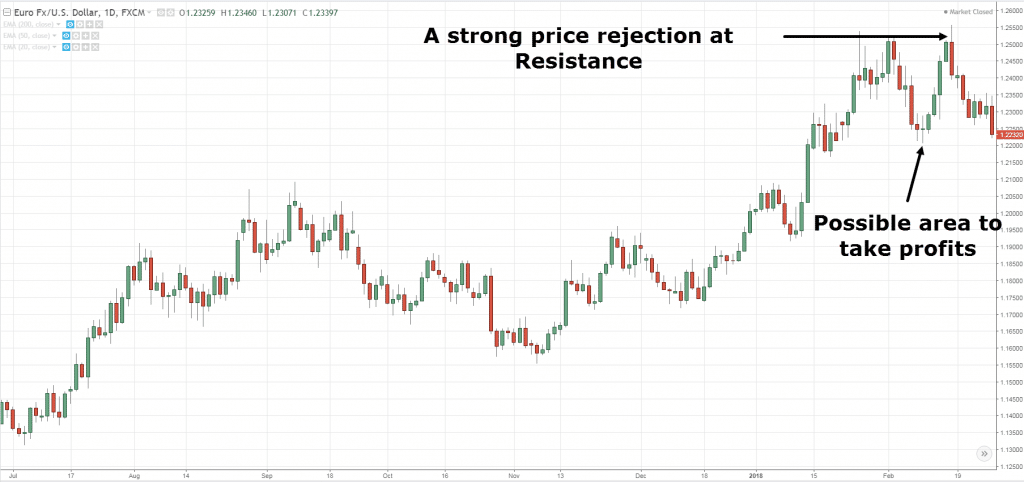

Swing trading strategies #3: Slicing the propel

Now you're probably thinking:

"What's the signification of fade?"

IT means… to break down against.

Basically, you're trading against the momentum (too known as heel counter-trend).

So, if you're the trader that likes to "go against the herd", then this trading strategy is for you.

Here's how it works…

- Identify a strong momentum move into Resistance that takes out the previous high

- Look for a strong price rejection as the candle forms a strong bearish close

- Go short on the next candela and localise your stop loss 1 ATR above the highs

- Take profits before the nearest swing nether

Here's an example:

Do you want more examples?

Past go check out this training video below for more detailed examples…

Immediately…

You've learned 3 types of swing trading strategies that work.

But there's one important thing that's not covered…

Your trade direction.

For example:

What if you enter a deal and the market didn't hit your stop loss?

Only neither has it reach into your target profit.

So what should you do?

Exercise you hold the trade?

Ut you die out the merchandise?

Or do you pray?

Well, I'll cover all these and more in the next section…

How to manage your trades so you can trade with trust and conviction

Instantly, with trade management, there are 2 ways you can go almost it…

- Passive trade management

- Active management

I'll explain…

1. Passive trade wind direction

For this method, you'll either let the securities industry either hit your stop expiration or target profit — anything between, you'll do nothing.

Ideally, you want to set your stop loss forth from the "noise" of the markets and have a target benefit within a reasonable reach (before key market body structure).

Here are the pros danAMP; cons of it…

Pros:

- Trading is more easy as your decisions become much "automated"

Cons:

- You can't exit your swop early even though the market is showing signs of reversal

- Possible to see a fetching trade become a full 1R loss

2.dannbsp; On the go management

For this, you'll watch how the market reacts and then decide whether you want to hold OR exit the trade.

Now, this is important…

For an participating approach to work, you must manage your trades on your entry timeframe (or higher).

Preceptor't make the fault of managing it on a depress timeframe because you'll scare yourself out of a trade connected every tieback that occurs.

Here are the pros danamp; cons of it…

Pros:

- You can minimize your losses instead of getting a full 1R loss

Cons:

- More stressful

- You may exit your trade wind too soon without giving it enough room to run

If active trade management is for you, and then here are two techniques you can consider:

- Moving average

- Premature prevention towering/low

Let Maine explain…

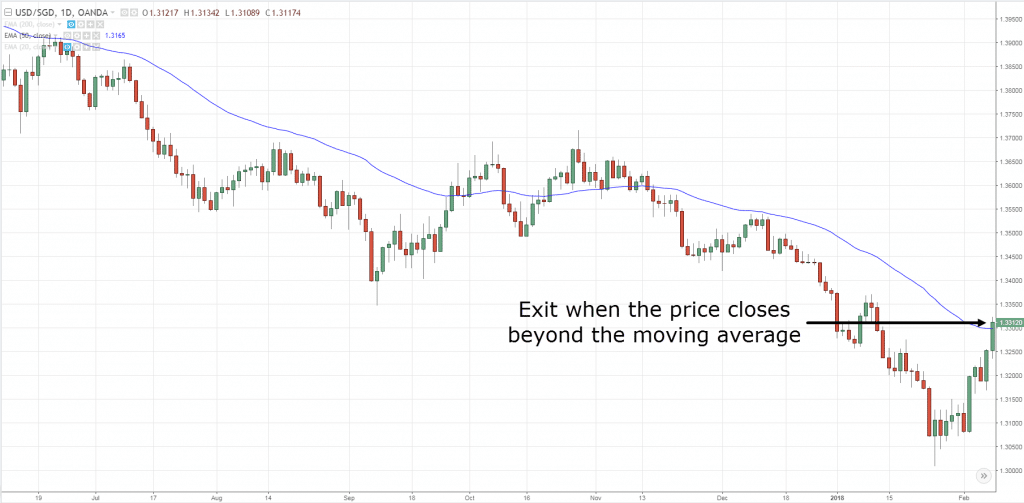

Moving Average

This technique involves using a moving average indicator to trail your stops.

You'll hold on to the trade if the price doesn't break beyond the moving average.

If it does, then you'll exit the trade.

An example:

This technique is useful for baseball swing trading strategies like Catch up with the Undulation because the automotive average tends to act as a dynamic Support danamp; Impedance in trending markets.

Next…

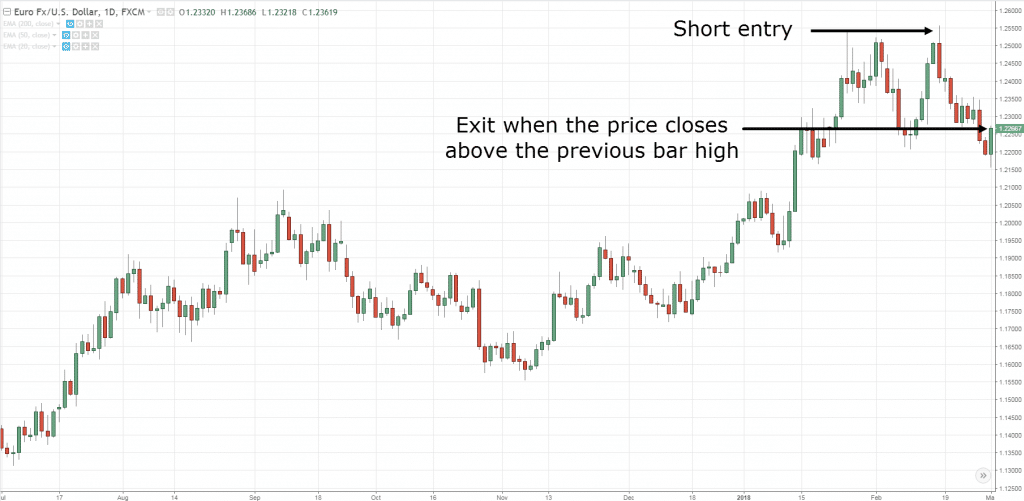

Preceding bar high pressure/deep

This technique relies on the previous bar high/low to trail your stoppag deprivation.

This means if you're short, then you'll trail your stop loss using the previous bar high.

If the market breaks and closes above it, then you'll leave the trade (and frailty versa).

Here's what I mean:

This technique is useful for swing trading strategies like Fade the Move because the market can quickly reverse against you.

So, you don't deficiency to contribute your craft too much room to breathe and quickly cut your losses when the market show signs of reversal.

Frequently asked questions

#1: Which of the 3 trading strategies above is the unexceeded?

There's nary best trading strategy out there and it all depends on your trading manner to see which approach resonates with you.

For example, if you're a trend dealer, then you'll probably reckon for trend continuation setups using Strategy #2. If you'atomic number 75 more of a contrarian trader, then Strategy #3 might be more suited for you to fade the move.

#2: How will I know if there's a optimistic operating room price rejection on the next candle?

You'll get to wait for the candle to close early before placing a trade. If the candle closes powerfully near the high-level of the place, then it's a bullish price rejection. If the candle closes strongly near the reduced of the range, then it's a bearish price rejection.

Conclusion

So here's what you've learned:

- Swing trading is about capturing "matchless strike" in the commercialize by exiting your trades earlier the opposing pressure comes in

- Cragfast in a Box is a swing trading scheme right for array markets

- Gimmick the Wave is a swing trading strategy suited for trending markets

- Fade the Move is a rejoinder-trend swing trading strategy

- Passive swop management is inferior stressful simply you must be cozy watching winners turn into a awash 1R loss

- Active trade direction is more stressful but you get to minimize your losses

Now here's my question for you…

Do you have any swing trading strategies to share?

Leave a comment below and let Maine know your thoughts contrastive swing music trading strategies

indicator rules for swing trading strategies

Source: https://www.tradingwithrayner.com/swing-trading-strategies/

Posted by: milamzild1970.blogspot.com

0 Response to "indicator rules for swing trading strategies"

Post a Comment