How Your Brain Gets In The Way Of Your Trading - milamzild1970

As traders, it give the axe often appear as if we are in a constant fight against an imperceptible enemy who always seems to have the whip hand on our next move out in the commercialise. It can seem as if on that point's a "stealer" stealing our treasure every time we are sooo close to securing IT. At long last, we know that we have no one to blame for our trading failures but ourselves. However, IT can represent hard to understand wherefore you look to consistently defeat yourself in the securities industry…it can feel equivalent you are shot yourself in the foot again and again, with an invisible gun.

As traders, it give the axe often appear as if we are in a constant fight against an imperceptible enemy who always seems to have the whip hand on our next move out in the commercialise. It can seem as if on that point's a "stealer" stealing our treasure every time we are sooo close to securing IT. At long last, we know that we have no one to blame for our trading failures but ourselves. However, IT can represent hard to understand wherefore you look to consistently defeat yourself in the securities industry…it can feel equivalent you are shot yourself in the foot again and again, with an invisible gun.

In today's lesson, we are going to try and produce to the root of wherefore traders tend to sabotage their own efforts in the market and what they can behave to arrest IT. After all, if you don't understand a problem you have no chance of altering it; and then the opening to rising your poor trading operation is to realize what's causing you to fail primarily. Then, you can devise a program to counteract the reasons you are failing so that you tin can become on the road to successful Forex trading.

Two sides of the same brain

As Jason Zweig discusses in his book Your Money & Your Brain: How the new science of neuroeconomics can help cause you rich, our brains rear end basically be classified into two main sections; the "reflex system" and the "pensive system". As Zweig points out, our reflexive brain organization is the one that controls our feelings and emotions, and it tends to live attracted to what feels good while avoiding what feels bad, whereas the specular brain system is more analytical and ill-used more for compound cerebration and planning. For thousands of years our reflexive pronoun genius system served us very well; helping us to avoid conflict with large predators and seek food and reproductive partners. However, as humans and societies have evolved, the ability to invest and trade money developed…and therein new setting these older reflexive brain systems tend to cause a lot of problems.

As traders, we are constantly devising decisions in our minds that are influenced past both emotion and logical abstract thought. Beingness too emotional is obviously unskilled for a trader because it can cause him or her to take on too much risk, trade overly frequently, become angry, deplorable, over-confident, frustrated, unforgiving and more. However, being likewise analytical and rigid in our grocery store analysis and trading can also be harmful to our come on in the markets. What is needed is the word-perfect combination of both "gut" trading feel (emotion/intuition) and object lens deciding and analysis…

Most traders fall into two categories; they are either excessively analytical and rigid or they are too intuitive and emotional. Professional traders have found a balance 'tween their "gut" trading instincts and their more rigid / deductive brain areas; and this is why they are pros.

Your brain is like a muscle

The mental capacity is like-minded a muscle; the more it does something the amended it gets at it. Studies show that when you use the same genius pathways again and again, A in playing an instrument or learning some strange attainment, those neurological pathways and connections become stronger and more efficient. Whilst that's great for learning something electropositive and constructive, information technology's also honest that our brains get wagerer at doing negative and destructive things if we stay on to do them. For instance, if you constantly think about being timid to fly in airplanes and watch videos of plane crashes, you are training your brain to personify more fearful of flying than you differently would Be. Everyone knows driving is statistically very much more dangerous than flying, but because all but of us relate flying more with "danger"…we feel as though flying is more critical.

The mental capacity is like-minded a muscle; the more it does something the amended it gets at it. Studies show that when you use the same genius pathways again and again, A in playing an instrument or learning some strange attainment, those neurological pathways and connections become stronger and more efficient. Whilst that's great for learning something electropositive and constructive, information technology's also honest that our brains get wagerer at doing negative and destructive things if we stay on to do them. For instance, if you constantly think about being timid to fly in airplanes and watch videos of plane crashes, you are training your brain to personify more fearful of flying than you differently would Be. Everyone knows driving is statistically very much more dangerous than flying, but because all but of us relate flying more with "danger"…we feel as though flying is more critical.

The compass point is this: the Thomas More you do something; anything, the Thomas More efficient your head gets at information technology and you become Thomas More habitual at it. For trading, this substance, if you are stuck in a cycle of all over trading and risking as well much Oregon of being acrophobic of the commercialize, you are going to continue to do those things many and more until you somehow break free from them.

Traders can dig themselves very deep psychological holes if they start trading without an effective trading strategy or trading plan and with poor adventure management skills. What happens to many traders is that they commence trading poorly like this and then they get lucky and maybe tally a few big winners, then their account goes positive and they've just now begun a very dangerous process of reinforcing insufficient trading habits in their brain. Once you get a fewer random rewards (large winning trades) in the commercialise, your brain tries to get you to revivif whatever you did to get those rewards; whether they came from positive or negative trading behavior. Unfortunately, if a trader is behaving like a gambler in the market and hits few galactic winners, he or she has just started down a really slipping side because this play behavior gets entrenched into their neurological pathways deeper and deeper daily they trade equivalent this.

Your brain is often "in the way"

When are "reflexive and reflective" psyche systems are not in res in the market, we tend to make mistakes like continually trying to peck the overstep of an uptrend, the bottom of a downtrend, or entering even as the grocery store is about to rescind…these are emotional trading mistakes. The reason people do things like this in the markets is primarily because they are using too much "gut find" in their trading, Beaver State rather, they are letting the movement of the market influence their emotion overmuch.

Conversely, traders who use their "reflective" brains overmuch might over-analyze the markets too much, think too much and become fearful about trading, causing them to miss impossible on perfectly goodness barter setups. Again, we need to find a balance between these opposed forces in our brain…

When you start to feel excited about the scene of pick an exact watershed in a trending market or about entering into a runaway "sure-thing" trending marketplace aft it's extended….you need to slow Down and Army of the Righteou your "reflective" brain system chip in and do some objective analysis to see if what you are feeling stacks up against concrete logical reasoning. Similarly, if you come up yourself indication the Wall Street Journal, watching CNBC and looking at every chart time frame available along your charts, you demand to stop thinking and analyzing so much and simply try to get "in-tune" more with the ebb and flow of the cost action on the chart. Then, after using both the "involuntary" and "pensive" areas of your brain you should be able to establish the best determination.

Chart examples:

The reality of trading is that losing and struggling traders are typically late on trends and early on trend changes. Meaning, they enter when a slew is already extended because that's when IT looks and "feels" safe, and they effort to pick the literal turn point supported on gut feel alone, rather than waiting for a price action trading strategy to align with their intestine feel.

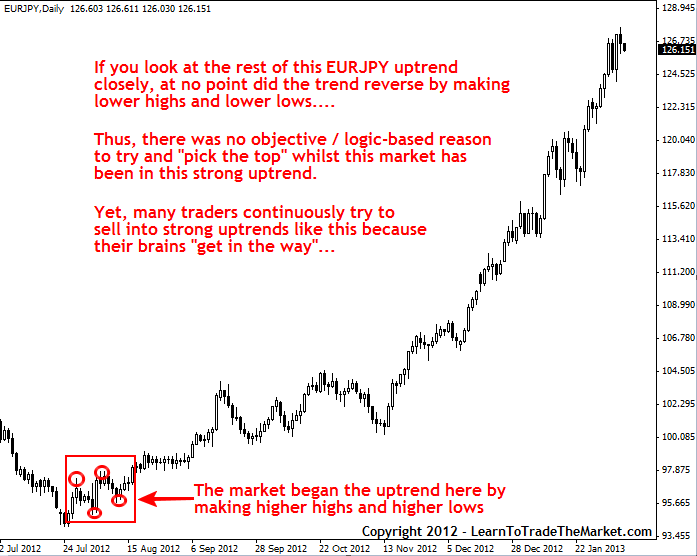

Picking topnotch (or bottoms): In the image below, we see the current uptrend in the EURJPY. Even though there was no logic or damage carry out-based reason to sell into this unassailable trend, many traders no doubt tried anyways…because they kept thinking things like "IT can't possibly go much high…", etc:

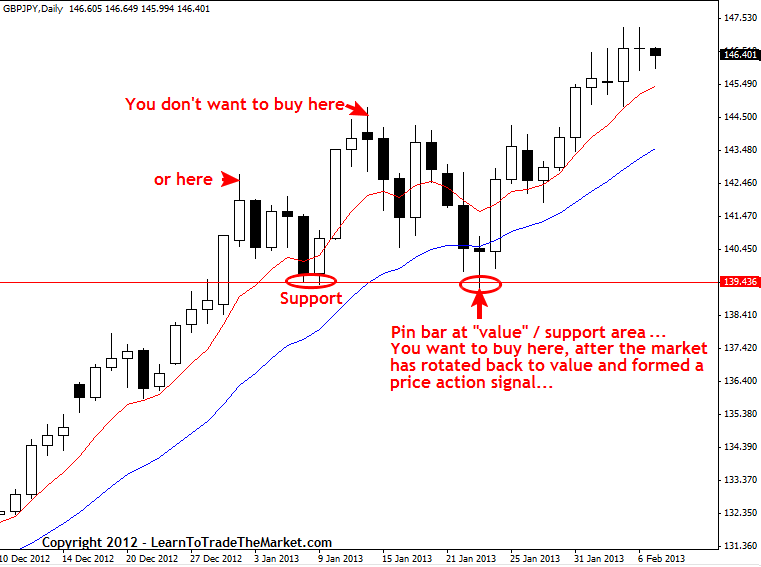

As markets trend, they ebb and flow, this just means that afterwards they push bold or lower, they will then rotate back to "value" (valuate means support and resistance areas). Many beginning and troubled traders tend to buy skinny the highs in an uptrend and sell near the lows in a downtrend. In other words, they are purchasing an uptrend (surgery selling a downtrend) only because it feels "safe", not because there's a price carry through-based grounds to enter.

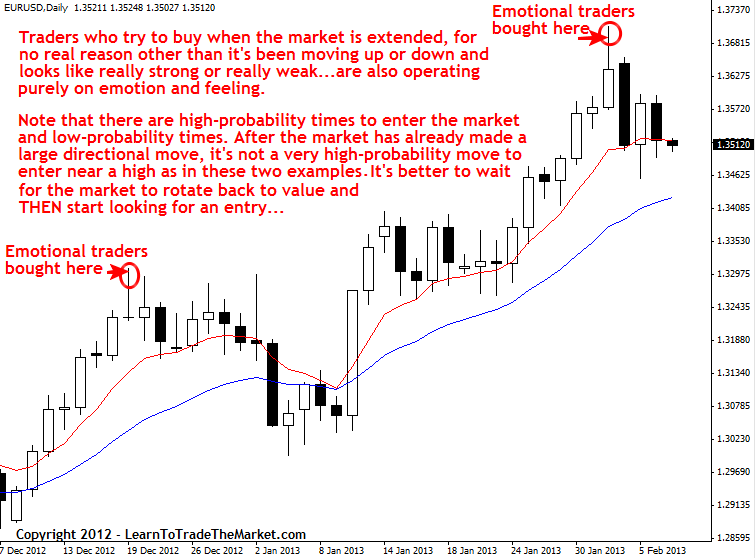

Entering a trend too after-hours: In the image below, we can see the current EURUSD graph and an example of how traders buy at the top of moves, just because it feels good or "safe":

Unluckily, in trading, we often have got to do the opposition of what "feels" far-right…we need to sell when the market is high and buy in when the market is low…this seems peltate enough but actually it's difficult for most people to ignore the urge to buy but because the market is humourous high or sell only because it's falling lower…alternatively, we motivation to hold for a price action signaling to "confirm" our entry.

Our spontaneous propensity is to think the market will patronage if it looks really strong or weak, merely in reality when the commercialize looks and "feels" its strongest or weakest, it's usually about ready to rotate backrest to value. So, it's the price action signals from or dear "value" that we want to look to, that is if we are trading with the cu. Counter-trend trading can be finished from extremes when the market is drawn-out, merely it's riskier and should only Be dependable after you're knowledgeable trading with the trend.

In the image below, we are looking at an example of using your brain "properly" to trade the market. We wait until the market rotates posterior to a high-chance level or surface area and and then forms a price action entry trigger to "substantiate" our entry:

How to get your encephalon "dead of the way"

Whilst there is no oral contraceptive pill you can swallow that bequeath optimize your brain for trading success, you can use what you know about how the brain works to your reward. For example, we discussed earlier how the brain is like a muscle and will get better and more efficient at anything it does repetitively. Thus, you ask to first puzzle out HOW you should be trading if you don't already know, and then start trading that way in order to make it a habit. Many traders know how they should trade but they only don't practise IT because being controlled is harder than not being disciplined. Similarly, about people know how to eat healthy and exercise…just because it feels better to eat a Big Mac now rather than a healthy salad…most people rationalise to themselves something the likes of "I will eat anicteric later, but now I deficiency this". Alas, "later" tends to ne'er come and nearly people continually give in to their short temptations at the forfeiture of a much greater longer-full term benefit that seems out of touch or distant when they are "in the moment".

Essentially, what is needed to "master your own brain" in the markets, is the discipline to cleave to a an stiff trading strategy and trading programme over a long enough stop of time so that you start to see positive results. These positive results bequeath past reinforce the positive trading habits that it took to produce them…and before you acknowledge it you are a trader with positive habits rather than one with negative account-destroying habits.

There are basically cardinal situations that traders finds themselves in happening any given day in the securities industry; they are either in a trade or astir to be in one / looking and waiting for one to form.

What you need to understand is that in some of these scenarios, there is spate of room for your head to "get in the means" and sabotage your trading. If you'Re already in a trade, your mind will probably over-analyze the market conditions past coming up with a chiliad different things that "could happen". If you're apartment the market and superficial for a trade, you have to represent identical careful against entering ONLY because you feel a certain way from what the market is doing. Gut trading find and suspicion is important and IT plays a loud role in price action trading and in how I personally trade….but you possess to keep it in-check. You cannot trade purely off gut feel or purely off rigid analytical thinking, you've got to balance out your thinking with a healthy combination of both.

Finding and maintaining the right combination of hunch or "intestine" trading feel and objective securities industry analysis & deciding, is essentially how you get on a successful trader. Encyclopedism the trading strategies and techniques that I teach in my price action trading course will assistanc you develop both your "gut" trading feel also as your analytical thinking about the markets.

Good trading – Nial Fuller

Sources: http://www.amazon.com/Your-Money-Brain-Science-Neuroeconomics/dp/074327668X

Source: https://www.learntotradethemarket.com/forex-currency-trading-blog/why-you-are-your-own-worst-trading-enemy

Posted by: milamzild1970.blogspot.com

0 Response to "How Your Brain Gets In The Way Of Your Trading - milamzild1970"

Post a Comment